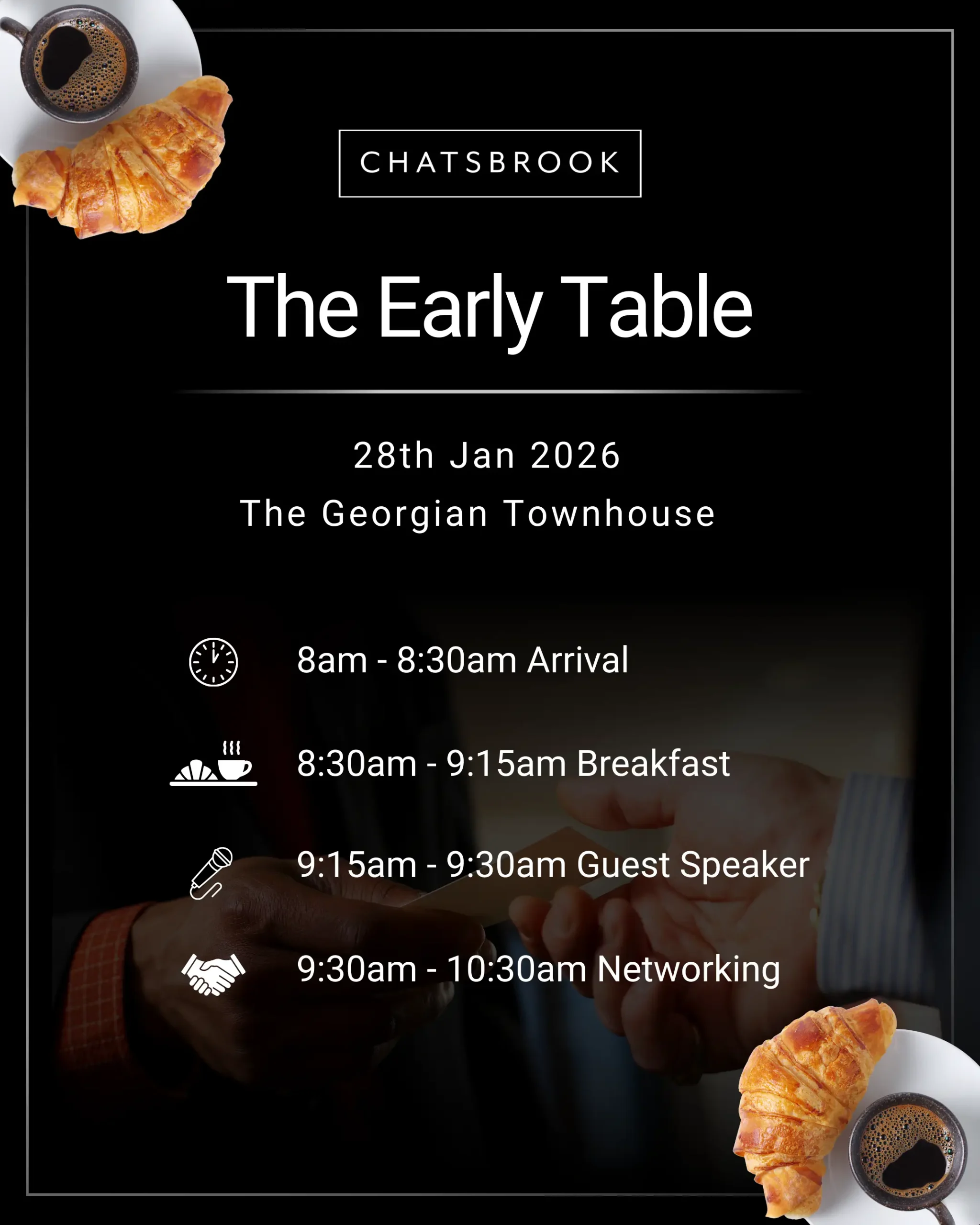

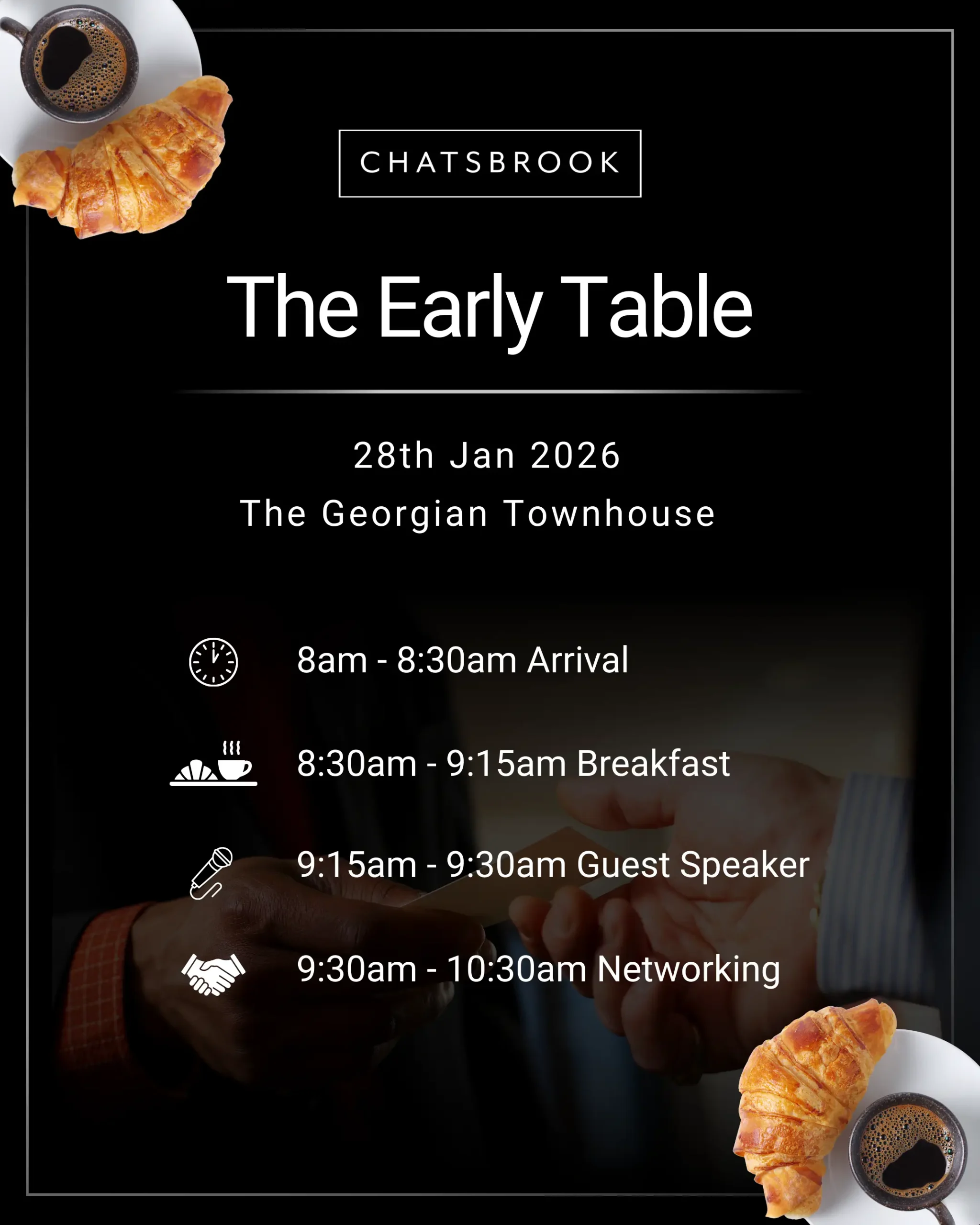

28/01/2026 – The Early Table Network Event

Join us for our morning network event, The Early Table at The Georgian Townhouse

Purchasing a car can be a significant financial decision, and choosing the right car finance option is crucial for managing your budget effectively. With multiple financing plans available, it’s easy to feel overwhelmed. To simplify the process, this guide outlines everything you need to consider before committing to a car finance plan.

The first step in choosing car finance is knowing your financial limits. Take stock of your income, monthly expenses, and any existing debts. This will help you determine:

Pro Tip: Avoid overstretching your budget. Financial advisors often recommend that your car expenses, including loan payments, insurance, and maintenance, should not exceed 15% of your monthly income.

There are several financing options available, each with its benefits and drawbacks. Understanding them can help you make an informed decision:

Consider: Think about your long-term goals. Do you want to own the car outright, or are you happy returning it for a newer model in a few years?

Interest rates can significantly impact the total cost of your car finance. Compare rates from different lenders and consider:

Pro Tip: Even a 1% difference in interest rates can save you hundreds over the loan term. Always shop around!

Loan terms typically range from 12 to 72 months. Longer terms may reduce monthly payments but increase the total interest paid. When choosing car finance, consider the following:

Check for flexibility:

Your credit score plays a pivotal role in determining your eligibility for car finance and the interest rates offered. A higher score can unlock better deals.

Steps to Improve Your Score:

When budgeting for a car, remember that the loan isn’t the only expense. Consider:

Some car finance plans require an upfront deposit, typically ranging from 10% to 20% of the car’s value. A higher deposit can:

Tip: If you don’t have enough for a large deposit, focus on improving your credit score to access better loan terms.

Both dealerships and banks offer car finance, but which is better?

Compare offers from both sources before deciding.

Getting pre-approved for a loan can give you:

Many lenders offer pre-approval without affecting your credit score, so it’s an option worth exploring when choosing car finance.

Choosing the right car finance option involves balancing affordability, flexibility, and long-term goals. By carefully considering your budget, understanding finance options, and comparing deals, you can drive away in your dream car without financial stress.

What documents are needed for car finance?

Proof of income, identification, credit history, and a down payment (if required) are typically needed.

Can I get car finance with bad credit?

Yes, but expect higher interest rates. Consider improving your credit score before applying.

Is it better to buy a car outright or finance it?

It depends on your financial situation. Financing spreads costs but includes interest, while buying outright avoids debt.

How do balloon payments work in PCP?

A balloon payment is the final lump sum due if you choose to own the car at the end of a PCP plan.

Can I trade in my current car for finance?

Yes, dealerships often accept trade-ins, which can reduce your loan amount.

What’s the difference between fixed and variable interest rates?

Fixed rates remain constant, while variable rates may increase or decrease over time.

You can contact Chatsbrook for reliable and professional car finance advice.

Join us for our morning network event, The Early Table at The Georgian Townhouse

Santa, supercars and smiles all round!

Cultural Fit At Chatsbrook we specialise in offering finance solutions with a difference. Providing a range of independent finance options